The Millennials (those born between 1980 and 2000) are getting married! And as this cohort of digital natives and online shoppers comes of age, the bridal industry faces new challenges to cater to them.

Such are the findings of a report written by IESE’s José Luis Nueno, with Silvia Rodríguez and ABN Metrics. Commissioned by Barcelona Bridal Fashion Week, the report focuses on Millennial-specific trends in the global wedding industry. It also homes in on the successes of the Spanish bridal industry, which has a turnover of close to 1.3 billion euros and employs 6,000 people in wedding dresses alone.

So, what makes marketing to Millennials different? For one thing, they are the most digitally accessible — and digitally dependent — of all demographic groups. With 2.7 devices per person, the study states that Millennials shift between them (smartphone to PC, to tablet, to console, etc.) up to 27 times a day. Even if today’s bride plans to buy a wedding dress offline, you can be sure she checked online for store locations, brand reputations, Instagram photos and more.

The Marrying Kind

First, it’s important to note that not all Millennials are getting married. The marriage rate in the world’s most developed countries is falling, with a few exceptions — the United States, Germany, the United Kingdom and Canada show a slight uptick. Millennials’ marriages are also happening later, as brides get their careers on track and struggle to overcome the setbacks of the global financial crisis.

Yet more wedding bells are ringing in the world’s developing countries. This is partly due to demographic shifts, which are expected to continue going forward.

While advanced economies have an aging population and fewer Millennials overall, in developing countries there are eight people of marriageable age (18-34) for each one in developed regions — a ratio that is expected to move to nine to one by 2030.

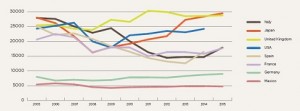

While the volume of weddings moves to the world’s developing markets, spending seems to be moving there, too. Before the global financial crisis hit, between 2005 and 2007, many mature markets reached a spending peak, with recovery only seen in the last few years (see chart).

The lesson for those in Europe and North America’s bridal industries is to look beyond the home market. “The wedding markets of the future will be ‘elsewhere,’” the report concludes. Internationalization is essential.

Capturing Millennial Attention

In the year 2020, the median age of the Millennial Generation will be 30 — a ripe time for saying “I do.”

The bridal industry needs to be ready to market to these digital natives effectively. Looking beyond demographic changes, the following factors present challenges and opportunities:

- Creative, user-friendly e-commerce. Millennials account for 46 percent of online clothing purchases (vs. just 32 percent of the online-and-offline total). While most wedding outfit sales continue to take place in brick-and-mortar shops, it’s only a matter of time before that changes.

- “The Age of Cheap.” Millennials grew up with discounts, fast fashion, outlets and low-cost options. There is no such model within the bridal industry… yet. Meanwhile, an absence of price competition (almost 85 percent of dresses sell for 1,000 euros or more) could mean rich rewards for a lower cost operator.

- Mobility is physical, not just digital. Millennials are quick to take advantage of low-cost flights to travel. They are also quick to move big events, such as weddings, to appealing destinations. Companies need to figure out the best way to attract these moving targets.

- The rewards of postponement. By delaying their nuptials until they are in their 30s, Millennials often have their careers well underway, and have more disposable income to spend on a bespoke wedding experience.

- The dress. Spending may have fallen on weddings as a result of the crisis, but the wedding dress segment of the industry was less hit than others. “Brides are giving up on mass weddings, but not their image,” the report insists. And while that dress is still most-often purchased in-store after various fittings, Instagram, Pinterest and other webs and apps are key to defining the bride’s interests.

At the End of the Aisle: What’s Next?

The report conclude with a list of nine consumer trends in weddings, many of which suggest means to maximizing profits for companies in the bridal industry:

- Dress the guests: evening gowns are a growth area, as guests will always outnumber brides. Women on their second marriage are also more likely to choose eveningwear.

- Double-dipping: Intercultural marriages are on the rise, and with them, the opportunity for brides to wear not one, but two outfits. These might represent the different cultures represented in her union, or it might be a simpler day-night divide.

- The wedding planner: As luxury weddings become standard and brides are busier with their own professions, the role of the wedding planner has grown considerably to deal with the complexities of flowers, invitations, venues and other tasks.

- The wedding celebrities: In the media, celebrities continue to publicize to the idea of the aspirational wedding. Increasingly, bloggers and reality shows also reinforce the importance of a traditional wedding with multiple stages.

- Plus-size: There are many opportunities in the plus-size wedding garment industry.

- Jet-away: Destination weddings present new opportunities, as couples aim to provide guests with a different experience.

- Omni-channel: With Millennials connected to so many devices, brands must embrace coherent and consistent communication across them — from Instagram accounts to e-commerce sites — even if brides ultimately buy their 1,000-plus-euro dress in the shop.

- The budget market: Not everyone signs off on luxury without checking the price. There are multiple opportunities in new markets for low-cost, second-hand or rented wedding dresses.

- Social media: It’s the best day of your life, so of course you want to share it online. From inspiration for gowns, to finding specialist wedding planners, social media offer huge rewards for savvy companies.

The Millennials may be slow to marry, but when they do, they will know exactly what, where and how they want their big day to be. The bridal industry is well poised to give it to them — if they can speak the language of the digital generation.

This article has been published by the “IESE INSIGHT Magazine” and “Financial Express” on May 16, 2016